Close right-side column

Select a Category

Your Life/Manage/FAQ

Security FAQ

Learn about security features for Online Banking and Mobile Banking

1. Why do I have to enter a verification code?

For security concerns, TLC uses Multifactor Authentication to protect your account from hackers and/or security breaches. Multi-factor authentication uses a minimum of two pieces of evidence to allow access to your account. You will be asked to authenticate each time you have changed your username, password, email address or phone number. In addition, you will be asked to authenticate each time you log onto a new device or if you clear your browsing history/cache. You can also choose to un-enroll a device you no longer use.

2. What are my options for the authentication process?

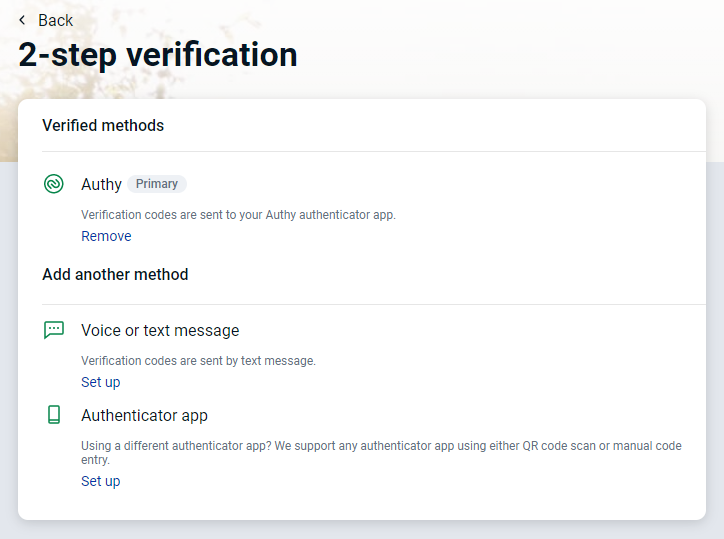

You have three options:

- Text message

- Phone call

- Authenticator app

Each option will give you a one-time code that you will have to enter into the screen where you are attempting to access online-banking.

*We support the "Authy" app which is available for iOS, Android and desktop. Download the app by search for "Authy". https://authy.com/download/

3. Can I set up multiple phone numbers?

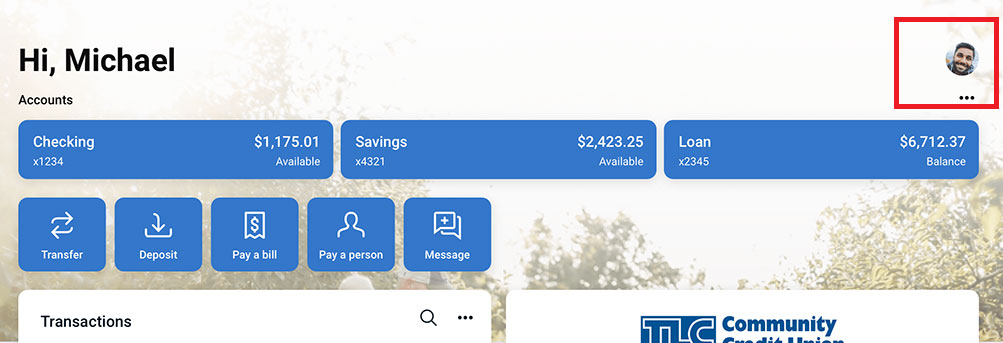

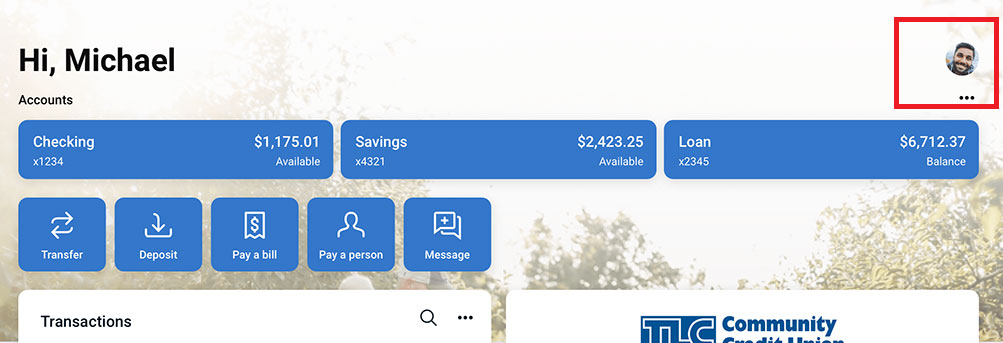

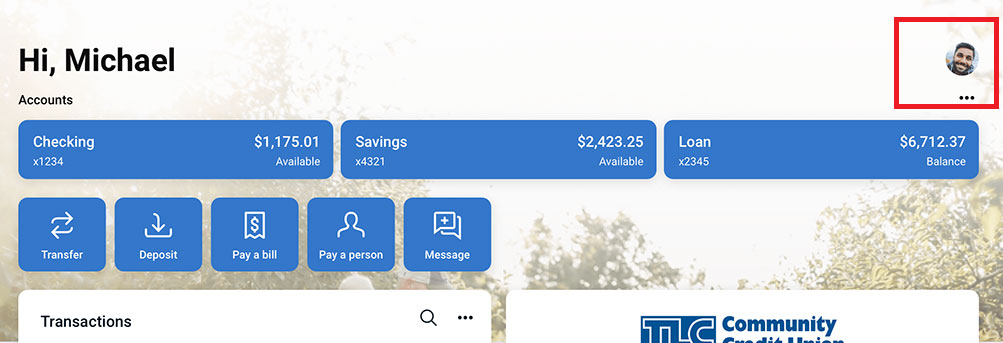

You can set up multiple phone numbers to receive verification codes by clicking on "Settings" in the upper right or lower left of your dashboard.

A code will be send to that phone number for verification. Enter the code when the verification box displays.

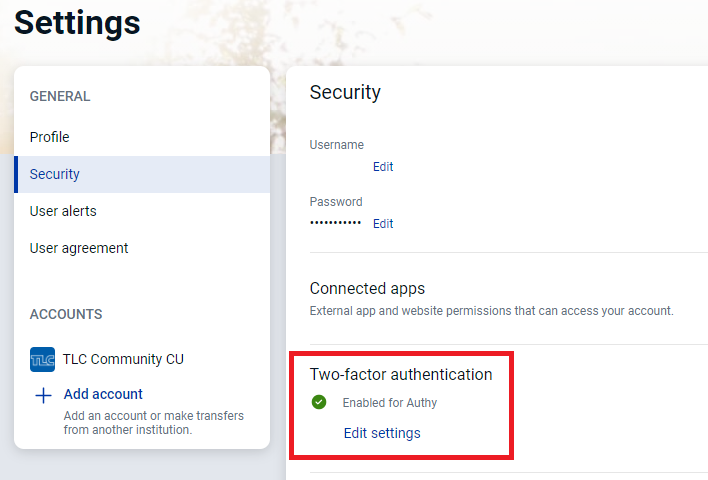

Select "Settings" from the menu and then select "Security."

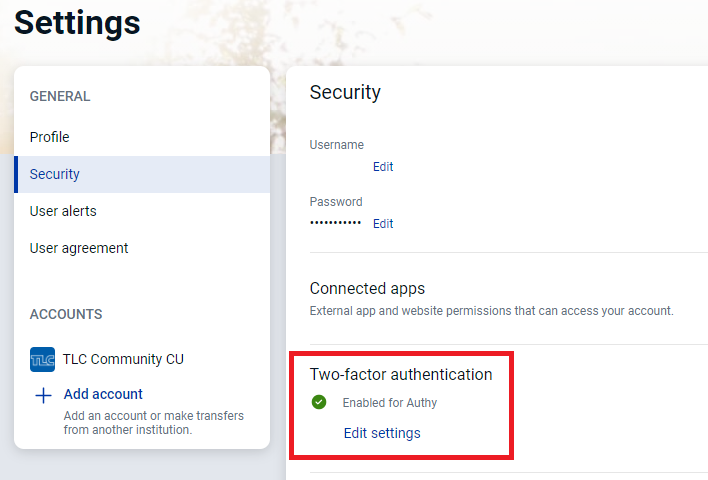

Click on "edit Settings" under the Two-factor Authentication section. You'll need to re-enter your password for security reasons.

You can then add or edit your 2-step verification settings.

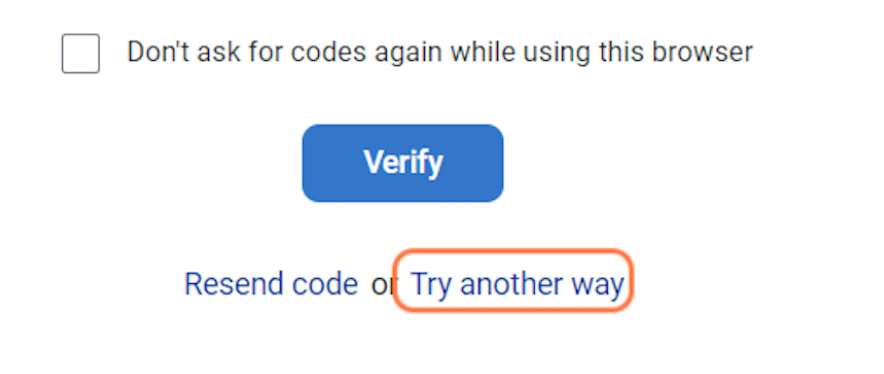

By default, the verification code will always be sent to the primary method first. Follow the instructions below to receive the code on a secondary phone number.

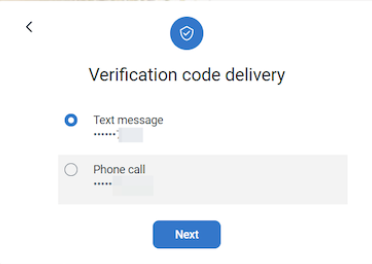

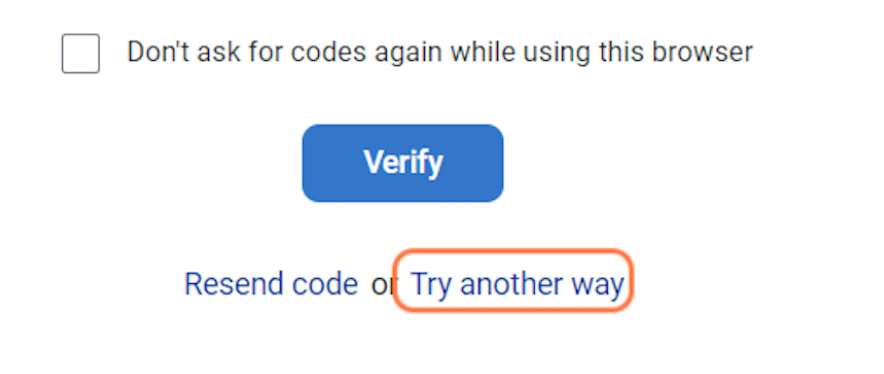

Once you log in, the code is sent to the primary method. On the verification screen, click try another way.

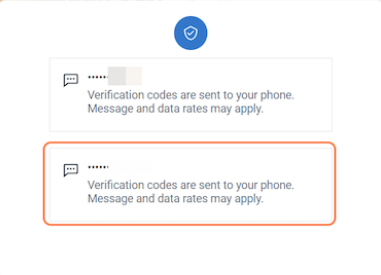

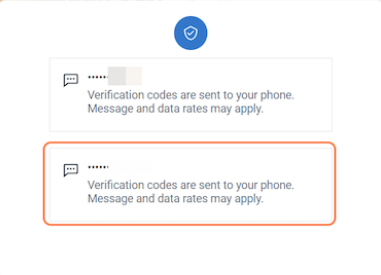

Click on the new number that you would like the code re-sent to

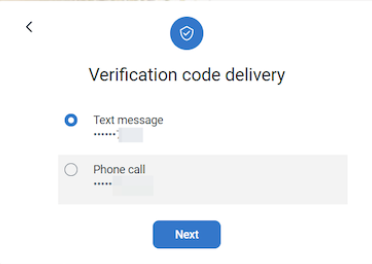

Click on the method of how you'd like the code to come to the secondary phone

number and click next.

number and click next.

A code will be send to that phone number for verification. Enter the code when the verification box displays.

4. Can I opt out of this process?

No, for your account security, this is a requirement to access Online Banking.

5. Will I need to reschedule bill payments/transfers if I re-enroll or reset my password?

No, your pending Online Banking bill payments or transfers will not be affected by re-enrolling in Online Banking. Your Online Banking preferences will remain the same.

6. Who do I contact regarding multi-factor authentication?

You can contact us at (517) 263-9120 during normal business hours.

7. How long are password verification codes good for?

1 hour

8. How long before I'm logged off due to inactivity?

10 Minutes.

9. What are the User ID and Password requirements?

Username requirements:

- Between 6 and 15 characters

- Must start with a letter

- No special characters

Password requirements:

- Must contain at least 1 letter

- Minimum 8 characters / maximum 20

- Allowed special characters include: !#$%&()+/;=?[\]^_`{|}*'

10. How do I change my password/ID after logging in?

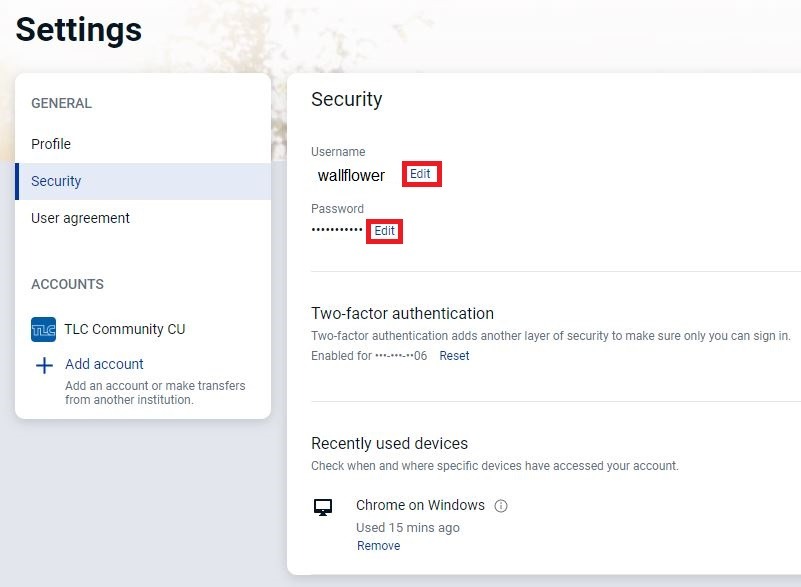

Yes. Click on "Settings" in the upper right or lower left of your dashboard.

Select "Profile" from the drop down menu and then select "Security."

You can then edit the areas you wish to update. You'll need to re-enter your password for security reasons.

Don't see your question?

We'd love to hear from you!

Zelle® and the Zelle® marks are property of Early Warning Services, LLC and are used herein under license.

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. Google and Google Play and the logos are a trademark of Google Inc.